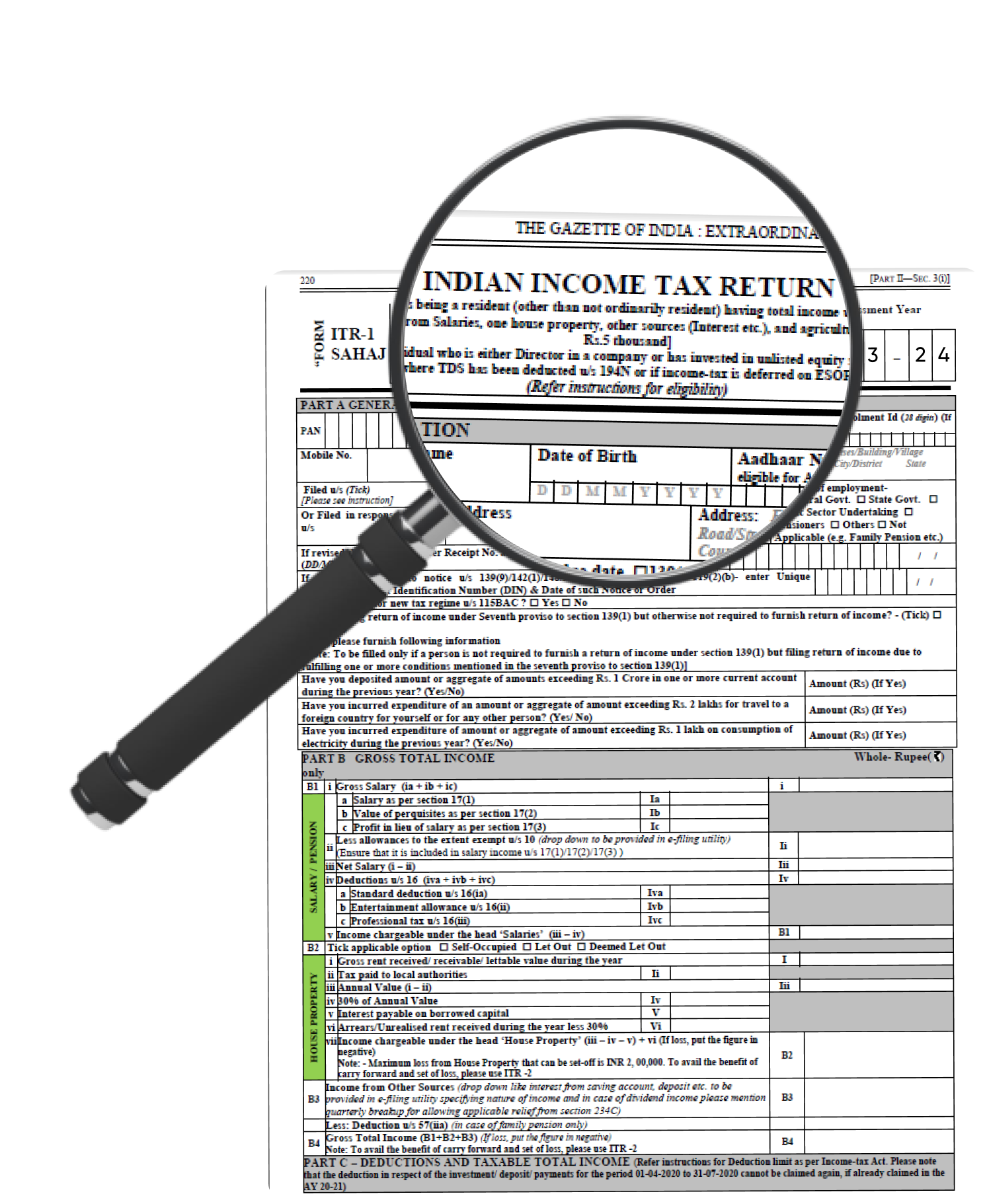

Every Salaried Indian should file Income Tax Returns. Leave it to us! Our tax experts will take care of everything for just ₹999.

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

,

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

,

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

+

Happy Clients

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

+

Years in Industry

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

,

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

+

Businesses Served

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

+

CA Experts

Last day to file for ITR 31 July 2024 *

₹1,999 ₹999 +Taxes

For Salaried individuals with salary less than ₹50 lacs

For salaried individuals with house property

Tax due/refund status and filing confirmation

Best Seller

₹2,999 ₹1,499 +Taxes

For Salaried individuals with more than ₹50 lacs

Dividend income of more than ₹10 lacs

Director in any Company

House property

PAN card

Essential for identification in all tax-related matters.

Form 16

This is given by your employer and shows your income and the tax that's been deducted.

Salary Slip

Crucial for e-filing, as they detail your monthly earnings and deductions.

Avoiding Tax Notices

Professional services reduce errors, minimizing the risk of tax notices from authorities.

Carry Forward Losses

Assist in reporting and carrying forward losses for potential tax savings in subsequent years.

Boosting Credit Score

Regular, accurate tax filing reflects financial responsibility, positively impacting your credit score.

Maximizing Deductions and Credits

Identify all eligible deductions, ensuring accurate payments and potentially increasing your tax refund.

Saving Time and Reducing Stress

Access expert advice on tax matters, particularly beneficial for complex financial situations.

Professional Advice

Identify all eligible deductions, ensuring accurate payments and potentially increasing your tax refund.

Audit Assistance

Invaluable support during audits, with professionals familiar with your financial history.

Keeping Track of Changing Laws

Stay up-to-date with evolving tax laws, ensuring constant compliance with professional services.

Risk hefty fees and legal consequences for failing to submit your Income Tax Return (ITR) on time

Risk fees up to ₹10,000 for delayed ITR. Ensure financial compliance, avoid penalties, and safeguard your fiscal standing with prompt filing

Timely filing ensures benefits, avoiding loss and impacting tax liability. File on time to secure deductions and maintain financial stability

Risk fees up to ₹10,000 for delayed ITR. Ensure financial compliance, avoid penalties, and safeguard your fiscal standing with prompt filing

Face 1% monthly interest on unpaid taxes post deadline. Ensure timely filing to avoid financial implications and maintain fiscal discipline.

Punctual filings enhance credit score; delays may affect loan approvals. Maintain financial credibility with responsible and timely ITR submissions

Swift ITR process for tight schedules. Connect with our experts for the quickest income tax return filing in the nation.

Filing ITR is our daily expertise. Our adept team ensures seamless and effortless income tax return submissions.

Share bank statements; we craft financials. Your ITR filed within two days. Enjoy a hassle-free experience with Trademarkia.

We handle all paperwork for a smooth interaction with the government. Clear process guidance ensures realistic expectations.

Expert advisors at Trademarkia ready to assist. Gain process clarity and proactive doubt resolution.

Your preferred choice for seamless online income tax filing. Trust us with your personal tax concerns.

For individuals earning above the specified income threshold, such as salaried employees, freelancers, and business owners. Essential for tax refunds and carrying forward losses.

Log in to the income tax e-filing portal, select 'e-File' > 'Income Tax Returns' > 'View Filed Returns'. Download ITR-V and forms, and check the status under 'View Details'.

Multiple registrations are required if your business operates in different states. Trademarkia simplifies this complex process and helps manage multi-state registrations efficiently

Mandatory for certain income levels and various financial activities. Acts as proof for loans, visas, and facilitates tax-related processes, providing convenience and compliance.

File your income tax return online, report income and deductions accurately. The tax authority processes refunds after assessing your return. Verify correct bank details for a direct refund deposit.

File for ITR today!

@ ₹999 + Taxes

Personalized Support

80+CA Experts

Legal Guidance